Ever paid $80 for a generic pill only to find out your neighbor paid $5 for the same one down the street? You’re not alone. In 2025, the cost of the same medication can vary by 300%-or more-between pharmacies just miles apart. This isn’t a glitch. It’s how the system works. And if you’re paying cash, you’re essentially shopping blind unless you know where to look.

Why Cash Prices Vary So Wildly

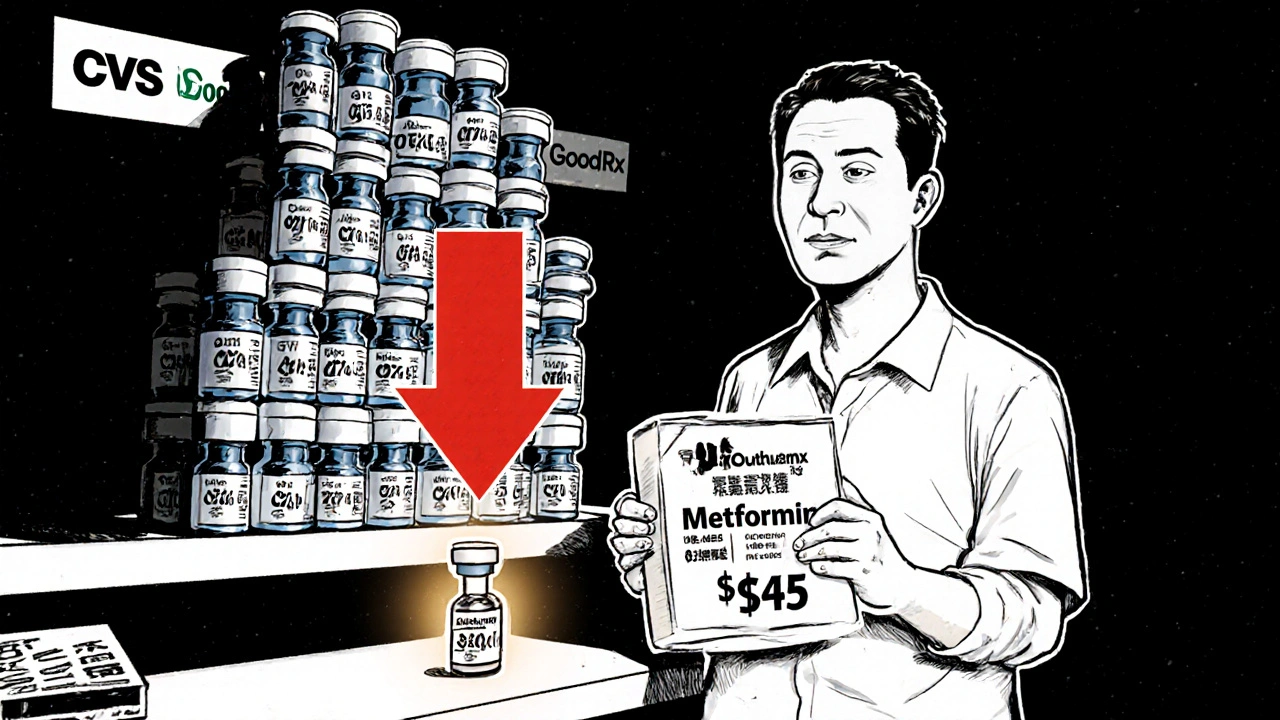

Pharmacies don’t set prices based on what it costs them to buy the drugs. They set them based on what they think you’ll pay. A national chain like CVS or Walgreens might charge $140 for a 30-day supply of atorvastatin (generic Lipitor), while a local independent pharmacy down the road sells it for $5. Why? Because the manufacturer gave the independent pharmacy a better deal. Or maybe the chain is trying to make up for insurance reimbursements that don’t cover their costs. Either way, the price you see at the register has almost nothing to do with the actual cost of the drug.Here’s the real kicker: your insurance doesn’t always help. High-deductible plans mean you’re paying out of pocket anyway. Even if you have coverage, the pharmacy might not pass along the discounted rate they get from your insurer. That’s why asking for the cash price before showing your card is critical. You might be shocked to find the cash price is lower than your insurance copay.

The Tools That Save You Hundreds

You don’t need to call every pharmacy in town. There are apps and websites built just for this. The most popular is GoodRx. It’s not an insurance plan. It’s a discount aggregator. GoodRx negotiates directly with over 70,000 U.S. pharmacies to offer cash discounts on both generic and brand-name drugs. In 2023, users saved an average of 88% on generics and 42% on brand-name drugs compared to the full retail price.But don’t rely on just one. Cross-check with RxSaver, WellRX, and BuzzRx. Each pulls data from slightly different pharmacy networks. One might show a lower price at Walmart, another at Kroger, and a third at your local independent. A 2020 NIH study found that for generic cardiovascular meds, supermarket pharmacies offered prices nearly half those of national chains when using discount coupons.

For example: a user on Reddit paid $1.89 for metformin at a local pharmacy using GoodRx. At CVS, the same prescription was $15.99. That’s $14 saved on a pill you take every day. Multiply that by 365 days, and you’re looking at over $5,000 a year.

Pharmacy Types: Where to Go for the Best Deal

Not all pharmacies are created equal. Here’s what the data shows:- Supermarket pharmacies (Kroger, Safeway, Publix): Often the cheapest for generics. Kroger’s $4/$9 program for select generics is a game-changer.

- Mass merchandisers (Costco, Sam’s Club): Costco doesn’t require membership to use their pharmacy in most states. Their cash prices are usually rock-bottom.

- National chains (CVS, Walgreens, Rite Aid): Usually the most expensive unless you’re using a coupon. Don’t assume they’re your best bet.

- Independent pharmacies: Often overlooked, but sometimes the cheapest. Many offer unadvertised discounts to regulars. Ask the pharmacist. Just say, “Is there any way to get this cheaper?”

For brand-name drugs, discounts are slim. GoodRx might only save you 10-20%. But if your doctor will switch you to a generic, you’ll save 80% or more. Always ask: “Is there a generic version?” If they say no, ask again. Sometimes the answer changes after a second look.

Mail-Order and Nonprofit Options

If you’re on a tight budget and take the same meds every month, mail-order is worth considering. RXOutreach.com is a nonprofit that provides generic medications at deeply discounted rates to people with household incomes under $45,000 (300% of the federal poverty level in 2023). You don’t need insurance. You just need proof of income.They offer drugs like metformin, lisinopril, levothyroxine, and simvastatin for as little as $10-$20 for a 90-day supply. That’s less than most pharmacies charge for 30 days. It’s not for every drug, but for the top 100 generics, it’s a lifesaver.

Medicare and Open Enrollment

If you’re on Medicare Part D, your plan’s formulary and preferred pharmacy network change every year. What saved you $10 last year might cost you $40 this year. During open enrollment (October 15-December 7), use Medicare’s Plan Finder tool. Look for plans with low copays on your specific meds. Some plans have preferred pharmacies where your drugs cost 15-25% less.And remember: the Inflation Reduction Act caps out-of-pocket drug costs at $2,000 per year starting in 2025. That’s huge. But it doesn’t mean you shouldn’t shop around. If you’re paying $150 a month for a drug that could be $30 elsewhere, you’re still wasting $1,440 a year-money that counts toward your cap.

How to Do This in 10 Minutes

Here’s your simple, step-by-step system:- Get the name of your medication and the exact dosage (e.g., “metformin 500mg”).

- Open GoodRx, RxSaver, and WellRX on your phone.

- Enter your medication and ZIP code. Note the lowest price from each site.

- Call the top three pharmacies. Ask: “What’s your cash price for this?” Don’t mention coupons yet.

- Compare the cash price to your insurance copay. Sometimes cash is cheaper.

- Use the coupon from the lowest price. Print it or show it on your phone.

- Ask the pharmacist: “Do you have any additional discounts for cash customers?”

That’s it. Takes 10 minutes. Saves you hundreds. Repeat every time you refill.

What Doesn’t Work

Some myths still circulate. Let’s clear them up:- Myth: “My insurance always gives me the best price.” Reality: Many insurance copays are higher than cash prices. Always ask.

- Myth: “GoodRx doesn’t work on brand-name drugs.” Reality: It does-just not as much. But if your doctor will switch you to a generic, the savings are massive.

- Myth: “Only poor people need to do this.” Reality: Middle-class families with high-deductible plans are the biggest users. One study found 70% of prescriptions have out-of-pocket costs.

And here’s a hard truth: if you’re taking insulin, you’re being overcharged. Prices for the same vial of insulin have ranged from $98 to $345 within a 2-mile radius in Chicago. That’s not a mistake. It’s exploitation. Use GoodRx. Use RXOutreach. Call your doctor and ask for a lower-cost alternative. Your life depends on it.

Final Tip: Talk to Your Pharmacist

Pharmacists know more than you think. They see the same drugs, the same prices, the same customers every day. If you’re a regular, they’ll often give you a discount you didn’t know existed. One study found 38% of independent pharmacies offer hidden discounts to loyal customers. Just say: “I’m trying to keep my costs down. Is there any way you can help?”It’s not about being cheap. It’s about being smart. Medications aren’t luxuries. They’re necessities. And no one else is going to fight for your savings. You have to do it yourself.

Can I use GoodRx with my insurance?

No, you can’t use GoodRx and insurance at the same time. But you can choose which one gives you the lower price. Always ask for the cash price first, then compare it to your insurance copay. Use whichever is cheaper. Many people save more by paying cash with GoodRx than by using insurance.

Why is the cash price sometimes lower than my insurance copay?

Insurance companies negotiate rebates with Pharmacy Benefit Managers (PBMs), but those savings rarely reach you at the counter. Pharmacies often charge more to make up for low reimbursement rates. Meanwhile, GoodRx negotiates direct discounts with pharmacies, which are passed straight to you. The result? Cash with a coupon can be cheaper than your copay.

Do all pharmacies accept GoodRx?

Almost all major chains and most independents do. GoodRx lists participating pharmacies on its app. If a pharmacy says they don’t accept it, ask them to call GoodRx’s customer service line. Sometimes they’re just unfamiliar with the program. Over 95% of U.S. pharmacies are in the GoodRx network.

Is it safe to use discount apps like GoodRx?

Yes. GoodRx and similar apps don’t replace your pharmacy-they’re just coupons. The medication you receive is the same as if you paid full price. The only difference is the cost. GoodRx has been used by over 200 million people since 2011 and is trusted by doctors and pharmacists nationwide.

What if my medication isn’t on GoodRx?

Some newer or specialty drugs aren’t covered yet. Try RxSaver or WellRX-they sometimes have different partnerships. If none work, talk to your doctor. Ask if there’s a similar generic drug you could switch to. Or check RXOutreach.com if your income qualifies. Even if it’s not on a discount site, calling local pharmacies directly can reveal hidden deals.

How often should I check prices?

Every time you refill. Prices change weekly. A drug that was $10 last month could be $25 this month. Don’t assume the price stayed the same. Set a reminder on your phone to check every 30 days. It takes 5 minutes and can save you hundreds per year.

Phil Thornton

November 29, 2025 AT 01:12Just saved $12 on my metformin today using GoodRx. I used to pay $16 at CVS. Now I go to the Kroger down the street. It’s not magic-it’s just knowing where to look.

Pranab Daulagupu

November 29, 2025 AT 14:40Pharmaceutical pricing is a black box designed to extract maximum value from necessity. The fact that a life-saving drug can cost $5 or $150 based on geography is a systemic failure, not a market feature.

Jermaine Jordan

November 30, 2025 AT 07:38This is the single most important financial hack for anyone on chronic medication. I used to think insurance was my friend-until I found out my $45 copay was $8 in cash. I now check GoodRx before I even hand over my card. It’s not frugal-it’s intelligent. This isn’t just saving money. It’s reclaiming your right to afford your health.

I’ve taught my elderly parents to do this. My mom saves $200/month on her blood pressure meds now. She cried when she realized she’d been overpaying for years. No one told her. No one was going to.

And don’t get me started on insulin. $345 for a vial? In 2025? That’s not capitalism. That’s extortion dressed in white coats.

Every time you refill, you’re negotiating your dignity. Don’t skip the 10 minutes. Your future self will thank you.

Alexander Levin

December 2, 2025 AT 06:15GoodRx is just a distraction. The real scam is the entire pharmacy-industrial complex. Pharmacies are owned by hedge funds. The drugs are made by corporations that lobby to block generics. This whole system is rigged. You’re just playing their game with coupons.

Also, why does anyone trust a company called GoodRx? Sounds like a phishing site. 👁️👄👁️

Barbara McClelland

December 3, 2025 AT 14:45Thank you for this. I’ve been too embarrassed to ask pharmacists for discounts-until now. I said, ‘I’m trying to keep costs down,’ and the woman behind the counter gave me a 15% off coupon she didn’t even have to offer. She said she does it for regulars all the time. Turns out, asking is the secret weapon.

Olivia Currie

December 4, 2025 AT 19:20I’m from the UK-we have the NHS, so this feels like a dystopian nightmare. I can’t believe people have to play price-guessing games just to survive. You’re not shopping for groceries-you’re negotiating for your life. This is barbaric.

Chetan Chauhan

December 5, 2025 AT 05:50goodrx is a scam bro. i used it and got a coupon that didnt work. then the pharmacy said they dont accept it. then i called and they said ‘oh wait we do but only if you say the magic word’ lol. also why is every site different? its like comparing weather apps.

Chris Taylor

December 6, 2025 AT 17:14My grandma uses RXOutreach. She’s on 4 meds and pays $18/month total. She’s 79, lives on Social Security. She didn’t even know this existed until I found it for her. This isn’t a tip-it’s a lifeline.

Sean Slevin

December 7, 2025 AT 06:47Why do we accept this? Why do we normalize the idea that your health is priced like a concert ticket? We’ve turned medicine into a luxury commodity. And the people who need it most? They’re the ones being priced out. This isn’t capitalism-it’s cruelty with a barcode.

And yet, we praise the ‘smart shopper’ instead of demanding systemic change. We applaud the person who finds a $5 insulin vial… while ignoring the fact that insulin should cost $2. It’s not a fix-it’s a Band-Aid on a hemorrhage.

Ady Young

December 7, 2025 AT 15:04Just tried the Costco trick. Didn’t need a membership. Walked in, asked for metformin, paid $7.50 for 90 pills. The guy behind the counter didn’t even blink. Just said, ‘You’re welcome.’

Also, my pharmacist at the independent place gave me a free bottle of vitamins because I’ve been coming there for 5 years. I didn’t ask. He just did it. Turns out, loyalty matters.

Travis Freeman

December 8, 2025 AT 21:51I’m from India, and I’ve seen how drug pricing works here-subsidies, generics, government oversight. It’s not perfect, but at least people aren’t choosing between insulin and rent. This post made me realize how broken the U.S. system is. I’m sharing this with my American friends. They need to know this isn’t normal.

Nathan Brown

December 8, 2025 AT 23:46There’s a quiet dignity in knowing how to navigate this mess. It’s not about being cheap. It’s about being prepared. When you’re the one holding the prescription, the only person who will fight for you is you. That’s not empowerment-it’s survival.

I used to feel guilty asking for discounts. Now I see it as an act of resistance. The system wants you to be silent. Don’t be.

Matthew Stanford

December 10, 2025 AT 11:48For anyone new to this: start with your top 3 meds. Check GoodRx, RxSaver, WellRX. Call 3 pharmacies. Pick the lowest. Do it once. Then do it again next month. You’ll be shocked how much changes. This isn’t a chore-it’s a habit that pays for itself.

And if you’re helping someone older? Walk them through it. They’re not tech-savvy, but they’re smart. They just need someone to hold their hand.

Curtis Ryan

December 10, 2025 AT 21:34just found out my local walgreens has a ‘community discount’ if you ask for it. i never knew. now i get my blood pressure med for $4.50. i feel like a genius. also i told my neighbor and now she does it too. we’re basically pharmacists now.

Rajiv Vyas

December 11, 2025 AT 17:58goodrx is a fbi sting operation. they collect your data then sell it to big pharma so they can raise prices even higher. why do you think the prices change every week? they’re testing you. you’re the lab rat.

also, why does every pharmacy have a different price? because they’re all owned by the same 3 billionaires. they’re playing you.

Melissa Michaels

December 12, 2025 AT 11:05For those on Medicare Part D: always re-enroll during open enrollment. Your plan’s formulary changes annually. A drug that was Tier 1 last year might be Tier 4 this year. Use the Medicare Plan Finder. Don’t assume anything. Your savings depend on it.

Also, many plans have preferred pharmacies. If your drug is cheaper there, consider switching your pharmacy even if it’s farther. The math always wins.

farhiya jama

December 13, 2025 AT 04:39Ugh. I’m tired of this. I take 7 meds. I don’t have time to play pharmacy roulette. Why can’t the government just fix this? Why do I have to be a detective just to breathe?